The market price of bearing steel may weaken in shock in May

Overview: From January to March 2023, the domestic production of bearing steel crude steel decreased by 0.69% year-on-year, and the output of bearing steel decreased by 2.63% year-on-year. Looking back at the bearing steel market in April, the overall trend was volatile and downward. The downstream demand started less than expected, and the mentality of businesses was frustrated. Up to now, the average price of domestic bearing round steel 50mm (continuous casting) is 5394 yuan/ton, which is 84 yuan/ton lower than that at the end of March, and the month-on-month decrease is 1.56%. Recently, the demand in overseas markets has weakened, and the export volume of bearing steel in the second quarter may shrink, and the pressure on domestic trade will increase. With the advent of the off-season, the demand for bearing steel has insufficient stamina. It is expected that the market price of bearing steel may weaken in May.

1. Domestic production of bearing steel

(1) Production of bearing steel from January to March 2023: Both steel and crude steel decreased year-on-year

According to statistics from the Special Steel Association, from January to March 2023, the crude steel output of my country's major high-quality special steel enterprises was 1.2304 million tons, a decrease of 0.69% compared with the same period last year; The output of bearing steel products of the enterprise was 1.0654 million tons, a decrease of 2.63% compared with the same period last year. See Figure 1 for details.

Figure 1: Changes in the monthly output of bearing steel crude steel and steel products in China since 2022.

Data source: Data from Special Steel Association and Steel Federation

(2) The output of finished products of bearing steel manufacturers from January to March 2023: the output of steel mills decreased year-on-year

It can be seen from Figure 2 that the current production enterprises with large-bearing steel production are: CITIC Special Steel (Xingcheng Special Steel, Daye Special Steel, Qingdao Iron, and Steel), Jiyuan Iron and Steel and Shigang, accounting for 59% of the total output. From January to March 2023, the overall output of bearing steel is decreasing. The output of steel plants such as Jiyuan, Shigang, Juneng, Nangang, Benxi Iron and Steel, and Zhongtian has increased slightly compared with the same period last year. The output of Manchurian, Bente, Dongbei Special Steel, CITIC Special Steel, and other steel mills all decreased.

Figure 2: The proportion of bearing steel output of major enterprises in the total output from January to March 2023

Data source:data from Special Steel Association and Steel Union

2. Domestic bearing steel market performance

In April, the price of the bearing steel market fluctuated and went down, and the overall market sentiment was poor. In terms of inventory, the trend of destocking continued in April, but the speed of destocking slowed down compared to March. Feedback from the current downstream situation shows that the demand for orders from downstream industries such as wind power, construction machinery, and automobiles is not optimistic, and the demand for bearing steel may remain low. In view of the limited support effect of the demand link on prices and the lack of confidence in the superimposed market, it is expected that the market price of bearing steel in May will show a trend of shocks and weakening.

Table 1: Current ex-factory acceptance prices of bearing steel mills

3. Relevant market information

(1) Raw material prices:

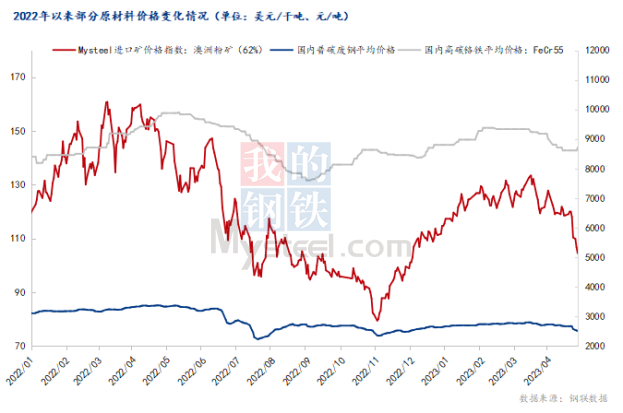

In April, the overall price of iron ore still showed a decline, and the current Mysteel 62% Australian powder index is 106.7 US dollars/dry ton. At present, the output of molten iron is at a high level in the year, and the demand for supply is generally strong in digesting capacity, but the capacity for destocking is constantly weakening, and it is slowly shifting towards the trend of accumulation. It is expected that the price of iron ore in May will still be dominated by weak shocks; the domestic scrap steel market will move downward as a whole after consolidation, with an absolute price of 2,997 yuan/ton. The decline in demand for steel scrap caused by production reduction and maintenance of steel mills is a foregone conclusion. After all, it is difficult for steel scrap to break through the downward channel. There is a high probability that the overall price of scrap steel will continue to decline in May; the market price of high-carbon ferrochrome has stabilized, and the price at the end of the month is 8611 yuan/ton. At present, the production cost of ferrochromium is mainly driven by the high price of upstream chromium ore, and it is difficult to improve the tight supply situation due to limited spot resources in the short term. It is expected that the production cost of ferrochrome will remain high in the short term.

Figure 3: Price changes of some raw materials since 2022. Data source: Steel Union data

(2) Downstream industries:

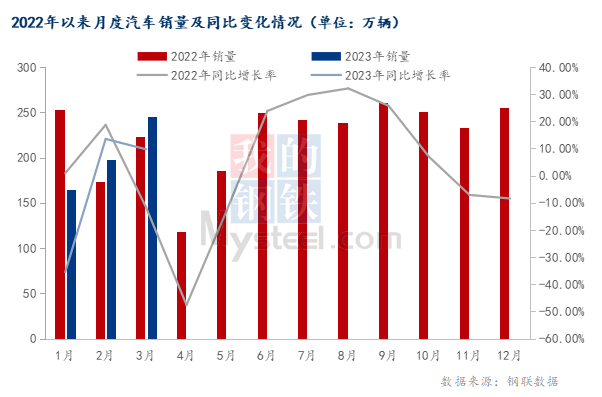

According to the statistical analysis of the China Association of Automobile Manufacturers, in March 2023, the production and sales of automobiles will be 2.584 million and 2.451 million respectively, a year-on-year increase of 15.3% and 9.7% respectively. In the first quarter, the production and sales of automobiles were 6.21 million and 6.076 million, respectively, down 4.3% and 6.7% year-on-year. In the first quarter, the auto industry entered a period of promotional policy switching, the withdrawal of the preferential tax policy for the purchase of traditional fuel vehicles, and the end of subsidies for new energy vehicles, etc., resulting in early consumption at the end of last year, and the relevant succession policies are still unclear. The price reduction of new energy vehicles since the beginning of the year and the wave of promotions since March have caused fluctuations in the terminal market, which has put the overall economic operation of the auto industry under greater pressure.

Figure 4: Monthly car sales and year-on-year changes since 2022. Data source: China Association of Automobile Manufacturers

4. Conclusion

In April, the market price of bearing steel fell weakly, and market pessimism was obvious. At present, the price difference between GCr15 price and 45# carbon structural steel has expanded, and the price difference of some steel mills has reached 600-800 yuan/ton. Major-bearing steel manufacturers rarely reduce production for maintenance. Under the high pressure of inventory, the flow of funds and risk control are particularly important. In the recent stage, the export volume of bearing steel pipe factories has continued to shrink, the demand has declined significantly, and downstream worries still exist. It is expected that the domestic bearing steel market price will continue to adjust in May, and the possibility of weak shocks is high.